Introduction to Forex –

Anyone with an internet connection has heard of Forex. For us Italians Forex indicates a particular type of trading, while in English it is simply the contracted form of Foreign Exchange , which indicates the exchange of foreign currency. This is why in many countries a foreign exchange counter as those of airports can be called Forex.

Anyone with an internet connection has heard of Forex. For us Italians Forex indicates a particular type of trading, while in English it is simply the contracted form of Foreign Exchange , which indicates the exchange of foreign currency. This is why in many countries a foreign exchange counter as those of airports can be called Forex.

Our Forex trading so it is nothing but a type of investment based on the value of different currencies. With the Forex work for currency pairs, as the investment is based on the difference in value between the two.

The first currency is called the base currency or the main building, while the second is considered the quote currency or counter currency.

For example we choose the pair of EUR / USD (Euro and US Dollar). The euro is the main currency you want to compare to the US dollar, graphically indicates the EUR / USD = 1.053 which means that one euro is worth 1,053 US dollars.

If I can sell each earn € 1,053 to 0.053 or if I buy the dollars and the euro will lose 0,053.

Here in this we have the basics of Forex.

On a Forex trading platform I can make an investment to rise or fall. I choose the currency pair that interests me, going back to the EUR / USD in this case, given that during the day the value of a currency is not stable but fluctuates decide if:

- invest predicting that the Euro gains on dollar

- invest predicting that the Euro against the dollar decreases

In the first purchase of the euro with the hope of selling them when the value increases and so realize my profit. In the second case purchase / sell it immediately at the current price Euro with the commitment to buy back at a later time. If the difference between the current price and the future is negative, that is to sell 1,200 to 1,050, and buy it again I gained on the downside.

This is the conceptual basis of forex trading which is then managed by the platforms in specific ways as we will see later. Now let us analyze some of the key concepts of forex.

- Currency Market : deal through forex trading can continue 24/24 except Saturday and part of Sunday. This happens thanks to the time zone differences.

For example: when in Italy is Sunday night, Australia and Asia is already Monday and the bags are opened. Then, when we have it’s Friday night in America it is still the afternoon and you can still make trades.

The most active markets are European and American, the Asian is quite stable, but there are various investments on the yen. The Australian market with currencies Australian Dollar and New Zealand Dollar (AUD and NZD) is usually less active.

And with this it introduces another theme: that of volatility. A market is considered volatile when changes during short periods of time are many. The more volatile a more one sees the trader’s skill Market: course in a volatile market risks are high but so are the profits.

- What is a lot? When you open a position, that is, you make an investment in the currency or stocks, you decide how much of the dispozione use capital. The Lot (Lot or English) is the unit of measurement used in the Forex to indicate the amount of currency you want to buy or sell. A lot corresponds to 100,000 units of the base currency, so for example with the euro a lot corresponds to 100,000 euro. There are lesser amounts in the lottery, called Mini lot, 10,000 units and Micro lot, 1000 units.

- What are pips?

A Pip is a unit of measurement of the price change and corresponds to the fourth decimal place of the quotation of the currency pair. An exception is the Japanese currency, the yen, where the pip corresponds to the second decimal place.

A Pip is a unit of measurement of the price change and corresponds to the fourth decimal place of the quotation of the currency pair. An exception is the Japanese currency, the yen, where the pip corresponds to the second decimal place.

How much is a pip in EUR? Simply multiply the volume purchased, for example, 1 lot = 100,000 euro for 0.0001 (fourth decimal place) getting so 10 euro for each variation of a pip.

- What is leverage?

The leverage and leverage is a financial instrument used as a multiplier of the invested capital. For example if you invest 10,000 Euros with leverage 1:10, we’ll have that capital invested will pay 100,000 Euros. So also the gain and loss% are multiplied. The levers are made available to brokers and common investors (non-banks etc.) who have limited capital and may participate in a limited way in the financial market.

The main levers used are:

1:10

1:20

1:25

1:50

1: 100

1: 200

1: 400

1: 500

For example with a 1: 100 every euro deposited corresponds to 100 invested real euro. In this case it can also say that the lever is of ‘1% (10% for 1/10 and cos’ etc.). For the novice investor is better to use a more limited leverage to limit the risks, also regulations of some financial institutions in the context suggests this approach.

- What is the spread? It is the spread of which they speak on TV that measures the difference between the interest on government bonds, but the value is expressed as a percentage representing the broker’s profit. In fact, we use the online trading platform of the broker and this will own a percentage of our transactions.

- What is a swap? This technique consists in the exchange of securities at a fixed rate and then gain after a certain period of time. For example I change EURO with a holder DOLLARS for x time and then I take back the dollars and the euro him. During the “exchange” I have a gain from the sale of something that currently worth little, then I will be returned when the euro I can have another gain from their increase in value.

Obviously it is a strategy that can work only those who are very good at making predictions: it is not a strategy that is said to lead to an actual gain in the long term.

- How do you invest via the web?

On the Internet there are companies or professionals, called Forex Broker , authorized to operate in the stock markets and currencies. These professionals provide users the ability to purchase the securities fractions that are actually in question. These tiny fractions are much cheaper and accessible and allow everyone to invest.

- Technically speaking the use of a derivative called CFD Contract For Difference . A derivative is an investment you do not speculate directly on a title in our possession, but about changing the value of it.

For example, if I live in the US but I have € 100,000 in the bank tomorrow and I hear that the Euro has tripled against the dollar I can decide to field those blocked money and make an investment of over $ 300,000 with my 100,000 EUR. My capital has suddenly tripled.

With a CFD I am not in possession of any capital, if the Euro against the dollar triples, I gain the position that I opened it a fraction, that is, maybe I have opened a position of 100 Euros on a forex pair EUR / USD and had a return of 300, but in my bank account I never became owner of foreign currencies.

So how could happen with the actions, I can have the Apple and sell shares when they increase in value, with CFDs can instead invest in their value, but I’ll never be the shareholder.

2. Forex Charts

When he began to apply the mathematical sciences at the trading charts they have been taken important. Thanks to a graphic display so we can … graphic precisely what happened in the past on the market and try to understand what can happen.

- Japanese Candlesticks : The most used type of chart is a Japanese candle (or candlestick ). This graph is composed of rectangles that resemble candles. They see pairs of candles in two colors, which are black and white, or red and green or another color indicates the fall and one the rise.

Even with this information before we can begin to understand how to interpret a candlestick chart: where is the red candle then we have prices falling, where blue or green or another color, up. The upward and downward variation is indicated by the long sides of the rectangle. The short sides instead represent the opening price and the closing: the underside tell us which was the opening price that led to that trend and the upper one to closure. Finally, the thin lines located at the center of the short sides, reminiscent of the wick or the flame of the candle, represent the minimum and the maximum reached for the candle in a specific time. Generally they analyze the candles ontimeframe (time window) of 1 minute, 5 minutes, 15 minuiti, 30 minutes, 1 hour, 1 day, 1 week, 1 month . So a single candle will represent the variation during the timeframe selected for the analysis.

- Linear Graph . Another common graphical, although less used by the experts, is the line graph . This is the classic chart where there is a jagged line, usually going to zig zag up or down. It is a very simple chart to interpret because it give us only the information on the closing prices and joining these points is off the line. Information is limited to this figure and thus is a graph used for quick glances but not many ideas on the scale of market movements.

- The bar graph instead provides the same four pieces of information of the candlestick chart: opening price, closing price, maximum and minimum. Graphically it makes less than candlestick chart because it uses only one color and therefore does not give the trader the same immediate information on the progress. Opening and closing are indicated by a short horizontal dashes that often seem to “cut” the vertical line between maximum and minimum.

As seen above, for each chart you can choose a specific timeframe, that is a time frame, which indicates the time period to display. The timeframe is important because different reference periods are different events. More the time period is short as the forecast is risky and difficult to confirm, as the time period is longer than we can get an idea of what can happen. Many forex traders choose short periods of time to do more tasks while others try their chance in the long run. Observe charts for periods of five minutes can easily lead to “false signals” that is, to find moments to invest if you look at the situation on a higher scale will show immediately blunders.

One of the best ways to get graphs for trading, which are candles, bar, line, and much more is Freestockcharts.com a site that offers graphics for real-time trading. The site has a free version available quickly and very powerful and paid versions with interesting options like custom alert for charts that monitor, support for multiple screens, etc …

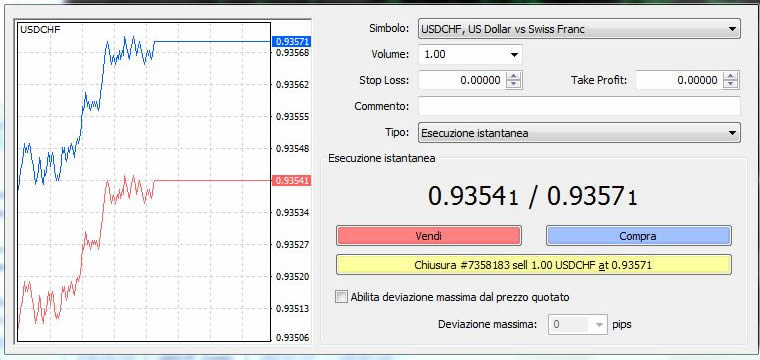

The trading platform Metatrader and Metatrader Webtrader , which are the most used by online traders offer their graphics integrated into the platform without having to go outside. The Metatrader charts with the latest version Metatrader 5 is very advanced and allow you to create complex graphs and all kinds. Webtrader is a light version of metatrader that works as a browser without downloading anything or offering candles graphics.

Many brokers with their trading platforms via browser or app offer graphics or offer a section of graphics within their websites.

Do not use the graphics equivalent to totally improvising their strategy but relying only to them is often not a good idea because we must also know the events that influence prices.

3. Tools for working with the forex: Metatrader and Webtrader

We have already mentioned in the previous paragraph to the platforms and Metatrader Webtrader trading. These platforms are both developed by the Russian-Cypriot company MetaQuotes specializes in developing software for online trading.

The company has a very long history that goes back to 2000. In 2005 he launched in 2010 Metatrader 4 and Metatrader 5 , both of which are also known by the acronyms MT4 and MT5 and both are still active and widely used. Many brokers and traders in fact still prefer Meta Trader 4 to version 5 while others are excited for the latest version.

Then there is the Webtrader version of Metatrader, for which sufficient access and Metatrader allows users to trade even when they are not with their computer usually available and can not download the platform.

Many online trading brokers use Metatrader platform as a broker, or have systems that are developed around the MetaQuotes Software.

Let’s see in detail some key features of Metatrader which help you in trading.

The first thing to understand when it comes to trading are the orders, that their trading functions.

- The first of these is a BUY order , or buy is an easy concept to understand. Buy means opening a bullish position. Purchase of securities to sell them when the price will be higher.

- The second is the SELL order , ie sell. Sell is investing downward. Now I sell the securities at the current price, but pay them at a later time, hoping for a lower price. This operation is also called “short” in the jargon.

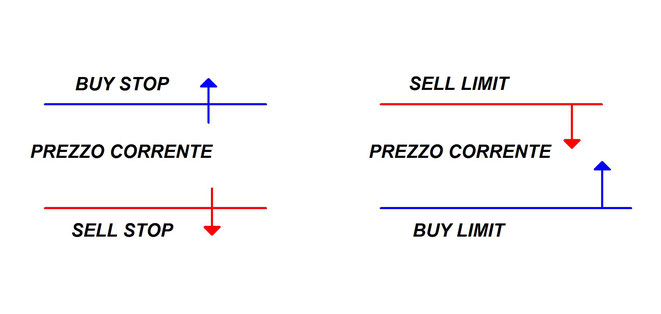

- BUY BUY STOP LIMIT and indicate the initiation of an order at a price higher and lower, respectively, compared to the present moment. SELL SELL STOP LIMIT and instead indicate, respectively, sales orders at higher and lower prices.

Again, there is a reason: we really want to make a bullish or bearish investment, but we are not sure that the current price give us confirmation of the trend that we see? By inserting the STOP LIMIT value or we can do from the order only when the actual value is actually changing, confirming our ideas.

- STOP LOSS instead is the value that is inserted (optionally) when it opens a position. He tells the system to close the position when losses reach a level decided by us, help prevent losing too much money especially when we are not connected to trade.

- TAKE PROFIT instead tells the system to close the position within a certain level of gain. For example let’s say the system to take the gain to 200 Euros. This protects us from sudden changes in trend that can turn a spot on trend in a resounding loss.

Another powerful feature in trading with Metatrader are so-called indicators. The indicators are statistical tools that belong to technical analysis (applied mathematics and statistics at the trading). In practice it is thought that when the graphics you experience certain situations repeatedly we can make a prediction based on statistics. Obviously statistical means high probability but not absolute certainty, so the indicator does not say that something happens in the 100% but that the probability is high.

The main indicators, ie the easier ones for beginners, are the Bollinger Bands , and the ‘ RSI .

The bollinger bands are the simplest: it is a series of three bands (curved lines) superimposed on the price chart. Prices are almost always contained within the three bands. If these SFOR, there is a state of overbought or oversold, that indicates the direction of trading.

The RSI indicator Relative Strength Index instead consists of a horizontal line drawn from the values 30 and 70. When the price chart ef the line 70 then there is a overbought if it is below the 30 instead there an oversold.

4. Types of Trading: Trends, Patterns and Trading of economic events

When you want to trade you have to first learn specific skills: risk management and that of the capital.

We talked above market volatility and stop loss and profit taking actions. Set of automatic controls that close the positions for us, since the platforms keep them always open and automatically renegotiate, it is the first thing to do to control the risks.

Second, remember that high-risk investments are those with a higher return but that does not mean we have to throw like crazy in every thing that seems risky.

The first rule is to know managing their money. One of the tips Money Management is to invest no more than 2% of the capital of a single operation. Which means that if I can use only 1000 euro to trade can not invest more than twenty euro for each position. This is true even if we begin to gain: we see the gains as part of the capital or maybe preleviamone one hand, keeping a fixed principal amount.

The Risk Management then tells us if a position is worth it or not: if we are spending 100 euro but we know that the gain would be 400 Euros then the game is worth the candle. We risk 1 to 4. If you take your return could be 200 or 100 then with a risk of 1 to 2 or 1 to 1 should not burn the money in this way.

The types of trading

After you understand the concept of risk and money management, let’s talk about trading types.

The first type of trading is more “human” that requires more intuition and creativity also is trading on economic events ( see the economic calendar ) and consists of trying to guess the trend in particular based on the information in our possession.

For example we know that the European Union has to decide whether to lower interest rates and introduce more liquidity in the market. A decision of this kind will certainly influence the Euro. Let’s say that in a hypothetical situation injection of money into the system increases so inflation decreases the value. So then the euro will be slightly depreciated and we can say that in any forex pair which has the euro as the main currency We can think of a downside.

Same thing can happen after an election, a financial maneuver, the resignation of the Government, a political conflict, a great financial crash. For example, a large company that fails can affect an entire nation.

The second method is called trend trading or trend following: is to find a trend and predict that this will continue over time. For this type of trading we rely on technical analysis. As mentioned previously using graphic and statistical models to predict that an event will occur or that a trend remains constant.

To do this we turn to the listed indicators also called oscillators. The indicators allow us to understand what happens in stages where the price ranges that will fluctuate long been among the same values. There is talk of sideways market and is equivalent to a standstill.

In technical analysis is then also use patterns : a pattern is a particular conformation of the graph in which some maximum and minimum united in some of the lines can form rectangles, wedges, various types of triangles and other shapes. Furthermore, it is important to learn to identify graphics on the media ie those points where a downward trend stops its fall and resumes the ascent and resistors ie those points where a bullish trend stops and begins to descend.

Some patterns are easy to find what others can give false signals significantly. Learning about the patterns and avoid mistakes requires a thorough study of technical analysis and charts, and you can not improvise.

In addition to the type of technique that follows to confirm the forecasts or have clues about what could happen, then there are trading styles that affect the way you invest. For example are the popular “day trading” based on operations that are opened and closed during the same day and the technique called scalping working on small variations and small gains. One scalper can also open 200 positions in one day!

Obviously to trade in this way must first have a good plan of money and risk management , then you understand many of the rules that affect the world economy. Both from the side of the events both from a statistical and mathematical side.

5. Strategies and Forex Trading Signals

After our rundown on technical analysis here other forex trading strategies that deserve to be considered and developed.

The Fibonacci numbers: the mathematician Fibonacci known of the past had discovered “the magic number” also called golden section. This is the number 1,618 that occurs frequently in nature and many forms, such as some spiral shells, are made in relation to this number. It has talked a lot about esotericism and novels (such as The Da Vinci Code) and this number also works for technical analysis. In some software for technical analysis in fact they exist Fibonacci retracements that indicate at what points you can find a trend of the trend that recalls the golden section. From here you can be expected the same trend on the dates that are identifiable precisely with the Fibonacci number.

Parabolic SAR : here we return in the field of indicators SAR stands for Stop and Reverse, and this indicator resembles a little the bollinger bands, as it is of parabolic lines drawn on price. When the graph in which you use this indicator price is below the Parabolic SAR, then it’s time to sell when the price is above you have to buy.

Hedging : The hedging is a very simple hedging strategy. It consists in opening opposite positions, which can have the same size or greater than the first position. For example forex same torque and the same investment, but one rising and one falling. This will always retrieve something and it remains more or less at the same or at least limited the capital exposure. Worth a try when trada on short time and maybe just after a loss you try to recover the opposite.

Martingale: is a strategy based on increasing (there are those who do it to decrease) investment steadily as a result of losses or gains. It is a double system, borrowed from gambling, which says that if you lose once to retrieve the second you have to invest twice, based on the likelihood that many consecutive losses are not as statistically possible we must aim to recover . This strategy can be risky because the investment and thus increases exponentially, even from positions of a few Euros, you can get to positions of great value. And ‘therefore essential to a large initial capital and the careful management of risk considering the subsequent investments.

Trading Signals: trading signals are often offered by brokers or other companies. They can be made either by experienced consultants from both software they use statistics and are sent to the trader as advice on what and how to invest. Often these signals offer a history of past performance and you can then have a try of their effectiveness. For example, a signal may have given correct directions in 80% of cases. Good signals are to be considered if the% of success is> 75%, better still between 80-90%.

Robots or EAs : based on mathematical algorithms and probabilistic robots try to think like a good investor without the emotional part. It is software used for automated trading. These robots, also known as EA, can be purchased and used on its own behalf by setting them with metatrader. It ‘still well in this case verify the results that these robots have given in the past. There are special tools to perform the backtesting of these robots, ie the verification of the results that would have given in the past based on historical data of market developments. Even MetaTrader 4 and MetaTrader 5 include a section of backtesting (more sophisticated in metattrader 5).

As final advice is important to stress that you should never improvise or blindly rely on a method or graphics alone but always use different methods and see if you confirm with each other.

It may also want to try on demo accounts before their strategies.

If you use third-party strategies, the reliance on financial companies or use of robots / eas, it is always good to ask and verify the results obtained in the past and present.

Always remember that trading investments have some risk and we must act cautiously, for more details you can refer to the disclaimer on the risks in trading